Ottawa, Nov. 28, 2025 (GLOBE NEWSWIRE) -- The Europe behavioral health market size is calculated at USD 36.82 billion in 2025 and is expected to reach around USD 63.23 billion by 2034, growing at a CAGR of 6.19% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6262

Key Takeaways

- The Europe behavioral health sector pushed the market to USD 34.67 billion by 2024.

- Long-term projections show a USD 63.23 billion valuation by 2034.

- Growth is expected at a steady CAGR of 6.19% between 2025-2034.

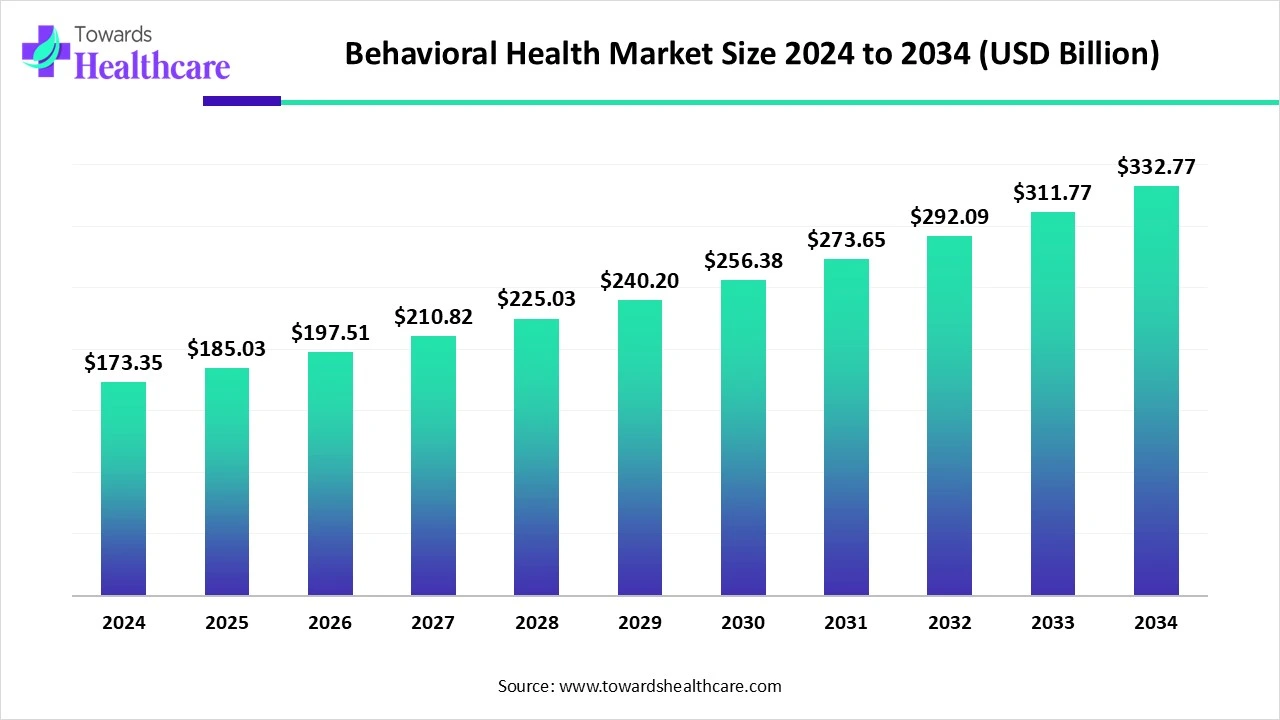

- The global behavioral health market is valued at USD 173.35 billion in 2024 and is projected to reach USD 332.77 billion by 2034, growing at a CAGR of 6.74%.

- By condition category type, the mood & anxiety disorders segment led the market in 2024.

- By condition category type, the substance use disorders (SUD) segment is expected to grow at the fastest CAGR in the studied years.

- By service modality type, the outpatient counseling & psychiatry segment held a major share of the market in 2024.

- By service modality type, the tele-behavioral/virtual care segment is expected to witness rapid expansion during 2025-2034.

- By patient age group type, the adults segment was dominant in the Europe behavioral health market in 2024.

- By patient age group type, the children & adolescents segment is expected to be the fastest growing in the predicted timeframe.

- By payer/funding type, the public & social insurance segment registered dominance in the market in 2024.

- By payer/funding type, the commercial/employer-sponsored segment is expected to grow rapidly during 2025-2034.

Introduction of a New Committee Supports Mental Health Concerns

Primarily, behavioral health refers to the state of a person’s mental and emotional well-being, which comprises their various behaviors and habits that are closely connected with their overall physical health. The Europe behavioral health market is specifically propelled by a rise in public awareness of mental health, supportive government initiatives, and the enhancement of digital health solutions, including teletherapy and mental health apps. Recently, a milestone step has been taken by Europe, the establishment of the European Parliament, a new standing committee on public health (SANT) that emphasises concerns, such as mental health.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Prominent Drivers Involved in the Market Expansion?

Europe is increasingly facing the prevalence of depression, anxiety, and substance use disorders, for which the European Commission reported that 7.2% of people had chronic depression in 2019, and the WHO predicts that over 84 million Europeans are affected by mental health concerns annually.

The Europe behavioral health market is further expanding with the ongoing innovations in digital solutions, specifically mobile apps, online therapy platforms, and virtual support groups to boost patient engagement and facilitate more accessible, real-time support.

What are the Transforming Trends in the Market?

- In September 2025, Paris-based mental health startup Moodwork raised €3.1M to accelerate its AI-enabled workplace mental health platform.

- In August 2025, Bristol-based Wanda Health, an intelligent platform for Remote Patient Monitoring (RPM) and Virtual Care, successfully closed an investment round of €2.1 million to escalate intelligent virtual care and minimise hospital readmissions.

- In June 2025, Mitel expanded its accessibility for virtual care and collaboration services, which allows better patient-centric care, mainly in seven new European markets (the UK, Belgium, France, Italy, Spain, the Netherlands, and Switzerland).

What is the Crucial Challenge in the Europe Behavioral Health Market?

A major limitation is a shortage of qualified psychiatrists, therapists, and counsellors across Europe, as well as improper and unequal access to care, and persistent social stigma, which are also impacting the overall market expansion.

Advancements in the Behavioral Health Market

| Companies | Announcements | Source |

| Biogen Inc. | ZURZUVAE® gained marketing authorization from the European Commission (EC) to treat post-partum depression (PPD) | Biogen Receives European Commission Approval for ZURZUVAE® (zuranolone), the First and Only Treatment Approved for Women with Postpartum Depression in Europe | Biogen |

| Sonomind | A non-invasive, personalised ultrasound brain stimulation platform will be developed to help people living with depression, with recently secured investments. | Sonomind Raises €3M to Advance Depression Therapy |

| Sheffield Health and Social Care NHS Foundation Trust | Name changed to “Sheffield Health Partnership University NHS Foundation Trust”, representing a powerful stride towards advancing mental health research and transforming mental health. | Mental Health Trust becomes Sheffield Health Partnership University NHS Foundation Trust. |

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

The latest developments in 2025 include the UK’s National Health Service (NHS), which has embedded telemedicine into its services. This further accelerates national-scale virtual wards, especially for chronic disease management, including mental health support. Moreover, the Europe behavioral health market has been stepping into novelty among major countries, whereas Germany has approved digital health applications (DiGAs) for depression and insomnia. In March 2024, 42% of all DiGA approvals targeted mental health issues, coupling these tools with the standard care pathway.

Global Behavioral Health Market Growth

The global behavioral health market is valued at USD 173.35 billion in 2024 and is expected to grow to USD 185.03 billion in 2025. Looking ahead, it’s projected to reach approximately USD 332.77 billion by 2034, expanding at a CAGR of 6.74% from 2025 to 2034.

Segmental Insights

By condition category type analysis

Why did the Mood & Anxiety Disorders Segment Lead the Market in 2024?

In 2024, the mood & anxiety disorders segment captured a dominant share of the market. Day by day, Europe is emphasising the wider adoption of comprehensive care models to highlight both mental and physical health, and tailored treatment plans for separate requirements. Currently, the government is enforcing policy initiatives, the integration of digital therapeutics (like AI and VR), and the rising understanding of the centrality of anxiety symptoms in the general population, mainly in vulnerable young adults.

On the other hand, the substance use disorders (SUD) segment is anticipated to expand fastest. The major step was taken in July 2024, i.e the evolution of the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA) was revolutionised into the European Union Drugs Agency (EUDA), for addressing the complex and quickly changing drug phenomenon. Alongside, Europe is accelerating emphasis on polysubstance use and highly potent novel synthetic opioids (nitazenes), with broader execution of harm lowering solutions, including take-home naloxone programs.

By service modality type analysis

How did the Outpatient Counseling & Psychiatry Segment Dominate the Market in 2024?

The outpatient counseling & psychiatry segment accounted for the largest share of the Europe behavioral health market in 2024. The segment is mainly impacted by a rise in consistent shift towards community-based, patient-centred care, and reforms focused on enhancing service coordination and effectiveness. However, Germany has proposed regional budgets for advanced care and stepped-care models for robust allocation of treatments based on severity and needs.

Although the tele-behavioral/virtual care segment will expand rapidly. The segmental growth is powered by regulatory integration into public healthcare, the application of AI and mental health apps, and the progression of hybrid care models. Besides this, the widespread emergence of AI-driven virtual assistants and chatbots (e.g., Wysa, Youper) is simulating Cognitive Behavioral Therapy (CBT) techniques, which are employed as a first line of assistance for anxiety and low mood.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By patient age group type analysis

What Made the Adults Segment Dominant in the Market in 2024?

Primarily, the adults segment held a major share of the Europe behavioral health market in 2024. Specifically, around the workforce, employers are widely supporting mental health programs and employee assistance programs (EAPs) for the reduction of stress and enhancing well-being, which ultimately raises access to care. They are using advanced mental health apps and chatbots for self-guided support, stress management, and mindfulness activities. They further enable ad-hoc emotional support and assist with early symptom monitoring.

Whereas, the children & adolescents segment is estimated to register rapid growth in the coming era. The expansion of technology and social media, and how children and young people engage with the world online, are mainly affecting the onset of diverse mental health issues. The European schools are highly fostering as a primary setting for universal mental health coverage, with expanded initiatives, like mental health literacy, lowering stigma, and offering on-site support for ensuring early detection and prevention of concerns.

By payer/funding type analysis

Why did the Public & Social Insurance Segment Lead the Market in 2024?

The public & social insurance segment captured the biggest share of the Europe behavioral health market in 2024. Europe is empowering coverage, minimising financial hurdles, and supporting public health initiatives. Belgium and Austria have explicitly boosted the range of psychological care encompassed by compulsory health insurance and its provisions. Whereas Ireland had put efforts into eligibility for its "GP Visit Card" program, with expanded primary healthcare access, significant for early intervention.

However, the commercial/employer-sponsored segment is predicted to expand at a rapid CAGR. A prominent catalyst is a rise in movement towards a proactive, preventive, and holistic approach, implementing digital health technologies and emphasising integration of mental well-being into the overall workplace culture. Numerous companies are exploring policies, like designated "brain break" or meeting-free days, to enable employees to focus on work time and take a break from constant virtual communication.

Europe Behavioral Health Market Value Chain Analysis

R&D

To develop personalized, effective, and accessible interventions for a wide range of mental health conditions, the R&D of Europe's behavioral health is focusing on leveraging digital technologies such as AI, digital therapeutics (DTx), and virtual reality (VR).

Key Players: Novartis, Roche, Atai Life Sciences.

Clinical Trials and Regulatory Approvals

The clinical trials and regulatory approvals in Europe's behavioral health focus on the dual and distinct pathways for medical products versus digital health solutions.

Key Players: Pfizer, Novartis, Roche, Atai Life Sciences.

Patient Support and Services

The patient support and services of Europre behavioral health include community-based and digital services such as telepsychiatry to specialized non-governmental organizations and digital health companies, where digital tools provide therapy access, personalized monitoring, and medication adherence.

Browse More Insights of Towards Healthcare:

The global behavioral rehabilitation market is expected to increase from USD 171.88 billion in 2025 to USD 235.89 billion by 2034, growing at a CAGR of 3.58% throughout the forecast period from 2025 to 2034.

The global behavioral health EHR software market size marked US$ 3.56 billion in 2024 and is forecast to experience consistent growth, reaching US$ 4.09 billion in 2025 and US$ 14.22 billion by 2034 at a CAGR of 14.85%.

The APAC behavioral health market size is calculated at USD 19.07 billion in 2024, grew to USD 21.46 billion in 2025, and is projected to reach around USD 56.58 billion by 2034. The market is expanding at a CAGR of 11.49% between 2025 and 2034.

The North America behavioral health market size is calculated at US$ 109.21 billion in 2024, grew to US$ 115.65 billion in 2025, and is projected to reach around US$ 193.03 billion by 2034. The market is expanding at a CAGR of 5.86% between 2025 and 2034.

The Latin America behavioral health market size reached US$ 5.2 billion in 2024 and is anticipate to increase to US$ 5.55 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 9.98 billion, growing at a CAGR of 6.74%.

The global cognitive behavioral therapy market size is calculated at US$ 7.77 in 2024, grew to US$ 9.01 billion in 2025, and is projected to reach around US$ 34.25 billion by 2034. The market is expanding at a CAGR of 15.99% between 2025 and 2034.

The U.S. behavioral health market size was calculated at USD 96.9 billion in 2025, to reach USD 101.84 billion in 2026 is expected to be worth USD 159.35 billion by 2035, expanding at a CAGR of 5.1% from 2024 to 2034.

The global digital behavioral health market size is calculated at USD 27.9 billion in 2024, grew to USD 33.1 billion in 2025, and is projected to reach around USD 153.85 billion by 2034. The market is expanding at a CAGR of 18.6% between 2025 and 2034.

The global behavioral health market size is calculated at US$ 173.35 billion in 2024, grew to US$ 185.03 billion in 2025, and is projected to reach around US$ 332.77 billion by 2034. The market is expanding at a CAGR of 6.74% between 2025 and 2034.

The Middle East & Africa behavioral health market size is calculated at USD 5.2 billion in 2024, grew to USD 5.55 billion in 2025, and is projected to reach around USD 9.99 billion by 2034. The market is expanding at a CAGR of 6.75% between 2025 and 2034.

Key Players: HelloBetter, Unmind, Spill, Flow Neuroscience.

Which are the Top Vendors and What are Their Offerings?

- Roche: It is one of the largest biotech companies that provides in-vitro diagnostics and transformative innovative solutions for major disease areas. Their main aim is to prevent, stop, or cure the diseases.

- Novartis: The company is one of the largest pharmaceutical companies, manufacturing a wide range of drugs. The company is focusing on the mental health and well-being of the people by discovering ways to improve and extend people’s lives.

- Atai Life Sciences: The company focuses on transforming patient outcomes in mental health care. The mental health innovations, pharmaceutical drug development, and biotech expertise are brought together in this company.

- Universal Health Services (UHS): It is one of the largest healthcare and hospital services providers. It operates 331 behavioral health inpatient facilities and 29 acute care hospitals.

- Priory Group (UK): It is the leading mental health and adult social care provider in the UK. It addresses a total of 70 conditions, such as depression, eating disorders, addictions, children’s mental health, and anxiety.

What are the Key Developments in the Europe Behavioral Health Market?

- In October 2025, Lyra Health launched a new “clinical-grade” chatbot created to address mental health issues.

- In April 2025, DocNow, a major provider of electronic health record (EHR) solutions, unveiled DocNow Telehealth, a secure, Zoom-powered virtual care platform developed especially for providers in Skilled Nursing Facilities (SNFs), Long-Term Care (LTC), and Home Health settings.

Europe Behavioral Health Market Key Players List

- Ramsay Health Care

- Acadia Healthcare

- Lifepoint Behavioral Health

- HCA Healthcare

- Magellan Health

- Sheppard Pratt Health System

- Carelon Behavioral Health

- Optum Behavioral Health (UnitedHealth Group)

- Teladoc Health/BetterHelp

- Lyra Health

- Talkspace

- Modern Health

- Headspace Health (Ginger + Headspace)

- Array Behavioral Care

- SonderMind

- Spring Health

- Brightline

- Quartet Health

Segments Covered in the Report

By Condition Category

- Mood & Anxiety Disorders

- Serious Mental Illness (SMI: schizophrenia, bipolar)

- Substance Use Disorders (SUD)

- Trauma & PTSD

- Eating Disorders

- ADHD & Neurodevelopmental (pediatric)

- Others (sleep, personality disorders, comorbid pain)

By Service Modality

- Outpatient Counseling & Psychiatry

- Inpatient Psychiatric Hospitals & Acute Units

- Partial Hospitalization (PHP) & Intensive Outpatient Programs (IOP)

- Tele-behavioral/Virtual Care

- Residential Treatment Centers (RTC) & Rehab

- Community-Based Services (ACT, case management)

- Crisis Services (988-aligned, mobile teams, CSU)

By Patient Age Group

- Adults

- Children & Adolescents

- Geriatric/Late-life Mental Health

By Payer/Funding

- Public & Social Insurance (Medicaid/Medicare/National Health Systems)

- Commercial/Employer-sponsored

- Self-pay/Cash/Charity

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6262

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest