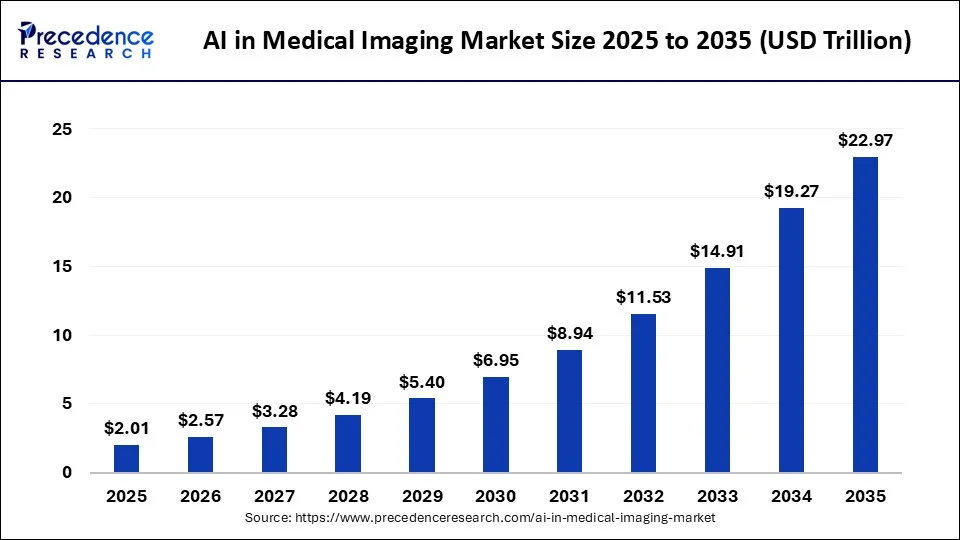

Ottawa, Jan. 23, 2026 (GLOBE NEWSWIRE) -- The global AI in medical imaging market is set to grow rapidly, reaching nearly USD 22.97 trillion by 2034, increasing from USD 2.01 trillion in 2025, driven by rising demand for early disease detection and automated radiology workflows. Increasing imaging volumes, growing chronic disease prevalence, and radiologist shortages are acceleratingthe adoption of AI across CT, MRI, X-ray, and ultrasound imaging. AI enables faster, more accurate diagnoses, improves workflow efficiency, and reduces clinical workload, positioning it as a critical technology shaping the future of diagnostic healthcare worldwide.

Growing demand for early-stage diagnosis of cancer, cardiovascular disease, neurological disorders, and respiratory conditions—which collectively account for over 70% of global deaths—continues to fuel adoption. At the same time, healthcare providers are leveraging AI to manage rising scan volumes and mitigate a 30–40% global radiologist workforce gap.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2380

What is AI in Medical Imaging?

The AI in the medical imaging industry growth is driven by the growing prevalence of chronic diseases, focus on earlier detection of diseases, development of personalised medicine, need for automation of routine medical tasks, and focus on reducing radiologists' workload.

AI in medical imaging is the process of using computer algorithms for the efficient & accurate diagnosis of diseases. AI minimizes scanning time and easily identifies complex patterns in magnetic resonance imaging (MRI), X-rays, & CT scans. Artificial Intelligence helps in the early detection of diseases and develops personalised treatment plans for patients. AI in medical imaging offers benefits like early disorder detection, better surgical planning, image segmentation automation, enhanced accuracy, and reduced human error.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

AI in Medical Imaging Market Snapshot

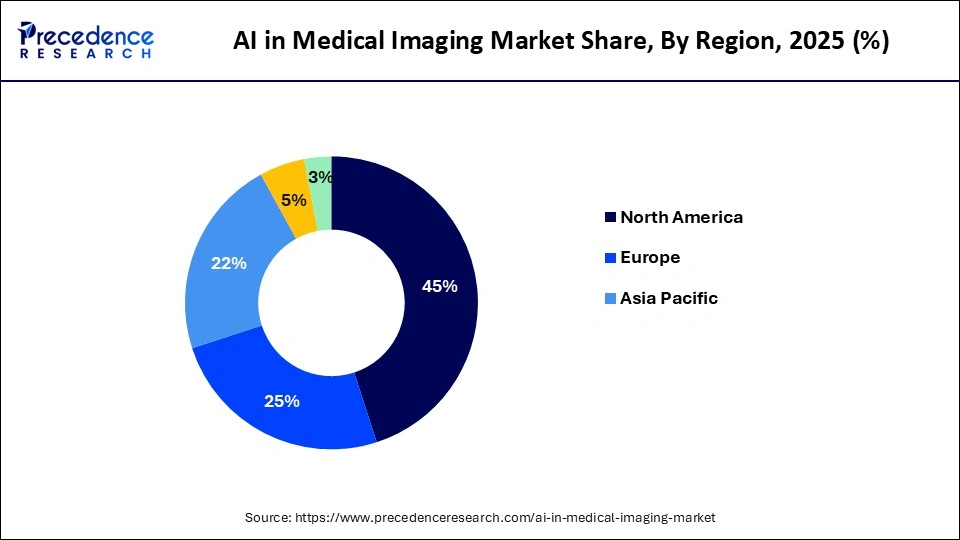

- North America led the market with 45% share in 2025, while Asia Pacific is the fastest-growing region at a 30.80% CAGR (2026–2035).

- Lung/Pulmonary imaging dominated clinical applications (22% share, 2025), with Oncology emerging as the fastest-growing segment (30.20% CAGR).

- Deep learning remains the core technology (48% share, 2025), while Explainable AI is gaining momentum (~30% CAGR).

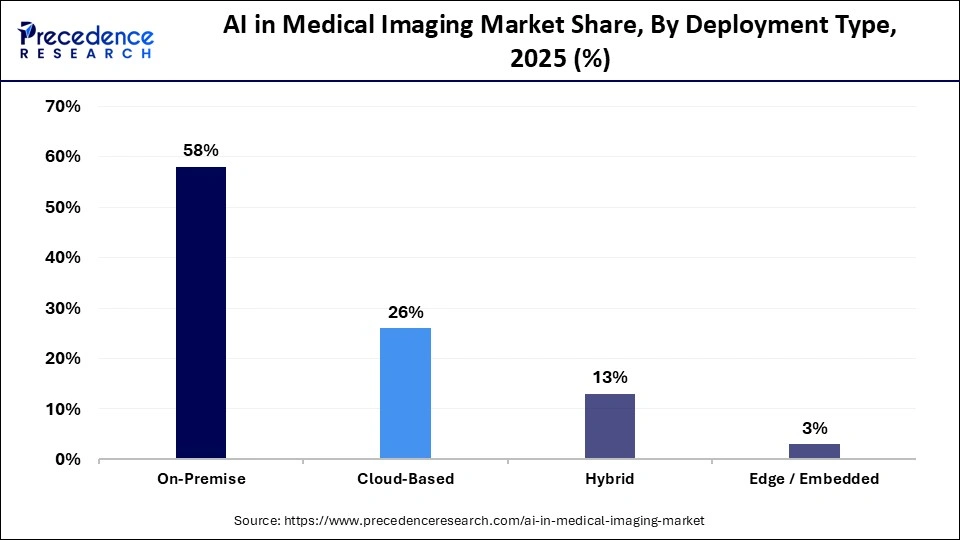

- On-premise deployment held the largest share (58% in 2025), but Edge/Embedded AI is accelerating rapidly (30.80% CAGR); cloud adoption continues to rise.

- CT imaging led by modality (37% share, 2025), while MRI is set for strong growth (~30% CAGR).

- Image analysis is the dominant functionality (51% share), driving automation and diagnostic accuracy.

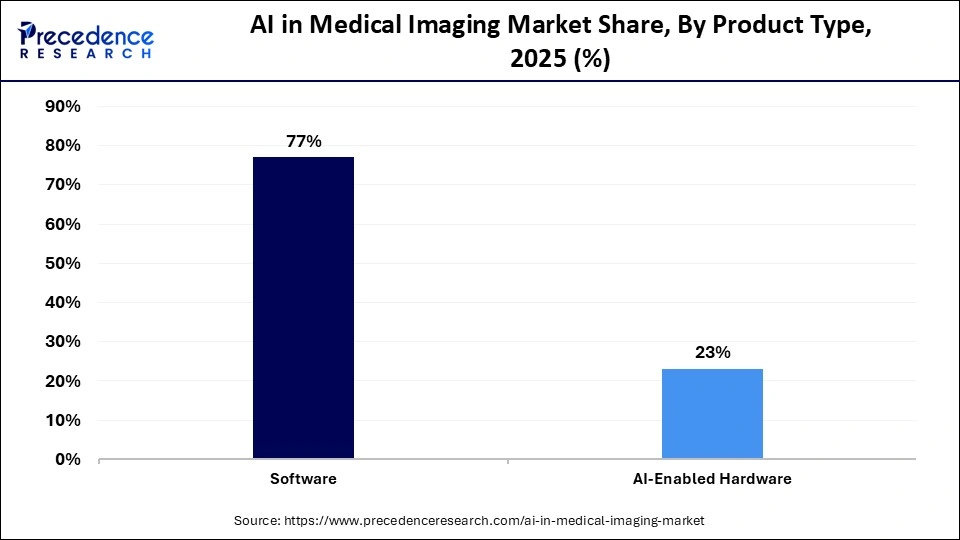

- Software solutions accounted for the majority of revenue (77% share, 2025), with AI-enabled hardware gaining traction.

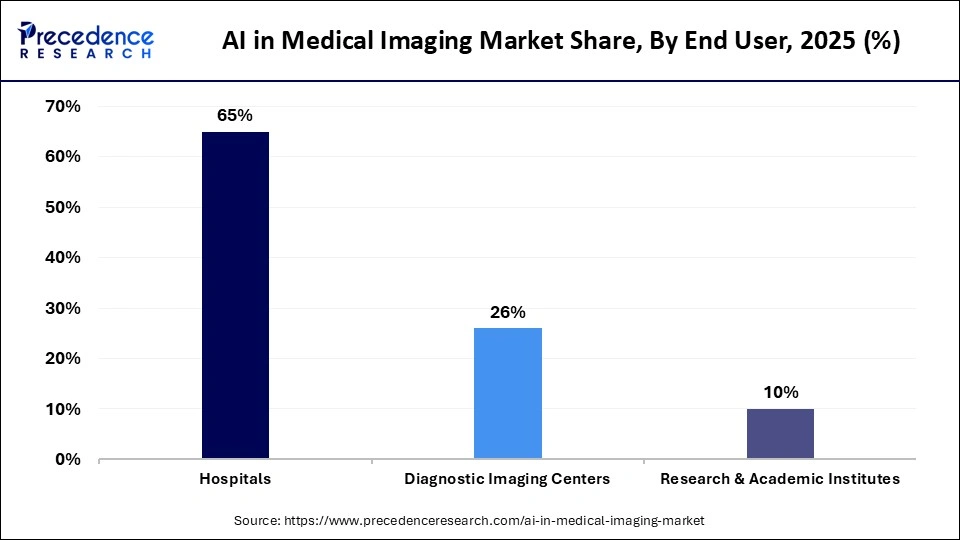

- Hospitals remained the primary end users (65% share), while diagnostic imaging centers are expanding fastest (28.90% CAGR).

➤ Get the Full Report @ https://www.precedenceresearch.com/ai-in-medical-imaging-market

Private Industry Investments for AI in Medical Imaging:

- Aidoc provides an AI-based enterprise platform (aiOS) that analyzes medical images (CT, X-ray, MRI) for critical findings like strokes and pulmonary embolisms, and then alerts care teams in real-time to speed up diagnosis and treatment.

- Viz.ai focuses on AI-powered care coordination for time-sensitive conditions like strokes by detecting the condition on scans and automatically notifying multidisciplinary teams to reduce diagnosis and treatment times.

- Qure.ai develops AI-powered solutions for medical image analysis and reporting, particularly for chest X-rays and head CT scans to assist in the early detection and management of conditions like tuberculosis, lung cancer, and stroke, especially in high-volume markets.

- Subtle Medical specializes in AI algorithms that enhance the quality and efficiency of medical imaging acquisition, allowing for faster MRI and PET scans or lower radiation doses without compromising image quality.

- Cleerly is a digital health company utilizing AI to analyze coronary computed tomography angiography (CCTA) images to quantify plaque and stenosis, which helps physicians in personalized treatment planning and early heart disease risk assessment.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Key Trends of the AI in Medical Imaging Market

- Generative AI for Diagnostics and Synthetic Data: Generative AI is moving into clinical practice to automate the creation of diagnostic reports and summarize patient histories for radiologists. It is also being used to create high-quality synthetic medical images, which allows for robust AI model training without compromising patient privacy or needing vast amounts of real-world data.

- Expansion of AI-First Radiology Workflows: Hospitals are increasingly adopting "AI-first" workflows where algorithms pre-analyze scans to flag suspicious areas and prioritize urgent cases, such as strokes or hemorrhages, for immediate review. This automation addresses critical global radiologist shortages by handling routine tasks, allowing specialists to focus on complex cases and reducing diagnostic fatigue.

Market Drivers and Economic Impact

- Imaging Volume Growth: Over 5 billion imaging exams annually, growing at 6–7% per year

- Workflow Automation: AI reduces reporting turnaround times by 30–50%

- Cost Efficiency: Improved scanner utilization and reduced repeat scans enhance ROI for providers

- Reimbursement Optimization: Faster throughput and improved diagnostic confidence support value-based care models

AI in Medical Imaging Market Opportunity

Growing Chronic Disorder Unlocks Market Opportunity

The growing prevalence of chronic diseases like neurological disorders, cancer, and cardiovascular issues increases demand for AI in medical imaging. The increased scan volumes and strong focus on early detection of chronic illness require AI in medical imaging. The increasing need for higher diagnostic precision and focus on streamlining repetitive tasks increases demand for AI in medical imaging.

The immense pressure on systems like MRIs, X-rays, and CTs, and increasing patient demand for tailored treatment, increases the adoption of AI in medical imaging. The growing demand for remote patient monitoring and focus on automating repetitive tasks increases the adoption of AI. The growing chronic disorder creates an opportunity for the growth of the AI in medical imaging industry.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Risks and Market Restraints

- High upfront integration costs

- Data bias and model generalizability concerns

- Interoperability challenges with legacy systems

- Data privacy and cybersecurity risks under HIPAA and GDPR

Regulatory and Compliance Landscape

Regulatory approvals are accelerating adoption. More than 700 AI-based medical imaging algorithms have received clearance globally from agencies such as the U.S. FDA, European CE authorities, and China’s NMPA. Growing emphasis on Explainable AI (XAI) supports regulatory transparency, clinician trust, and ethical deployment.

AI in Medical Imaging Market Report Coverage

| Report Coverage | Details |

| Market Size (2025) | USD 2.01 Billion, with AI adoption in imaging present in ~35% of large hospitals globally |

| Market Size (2026) | USD 2.57 Billion, supported by 20%+ YoY growth in global diagnostic imaging volumes |

| Market Size by 2035 | USD 22.97 Billion, representing a ~11× market expansion over the forecast period |

| Growth Rate (2026–2035) | 27.57% CAGR, significantly outpacing overall healthcare IT growth (~12–14%) |

| Base Year | 2025 |

| Forecast Period | 2026–2035 |

| Imaging Volume Impact | Over 5 billion medical imaging exams performed annually worldwide, growing at 6–7% per year |

| Radiologist Workforce Gap | Global radiologist shortage estimated at 30–40%, accelerating AI adoption |

| Key Growth Drivers | Early disease detection, chronic disease burden (70% of global deaths), workflow automation, precision medicine |

| Clinical Adoption Rate | AI-assisted image analysis used in >45% of stroke and pulmonary imaging workflows in developed markets |

| Technology Dominance | Deep learning holds 48% share, improving diagnostic accuracy by 20–30% in high-volume imaging |

| Explainable AI Growth | XAI growing at ~30% CAGR, driven by regulatory and clinical transparency requirements |

| Deployment Split (2025) | On-premise 58%, Cloud & Hybrid ~28%, Edge/Embedded ~14% |

| Edge AI Performance Gain | Edge-based AI reduces image processing latency by 40–60% in emergency settings |

| Imaging Modality Share | CT 37%, MRI ~26%, X-ray & Ultrasound ~30% combined |

| MRI Efficiency Gains | AI reduces MRI scan time by 25–50%, increasing patient throughput |

| Functionality Adoption | Image analysis accounts for 51% share; segmentation accuracy improved by >90% in oncology use cases |

| Product Mix | Software 77%, AI-enabled hardware 23%, with hardware growing at ~28% CAGR |

| End-User Split | Hospitals 65%, Diagnostic Imaging Centers ~22%, Research & Academia ~13% |

| Fastest-Growing End User | Diagnostic imaging centers at 28.90% CAGR, driven by outpatient diagnostics |

| Regional Leadership (2025) | North America 45% share, backed by highest per-capita imaging utilization |

| Fastest-Growing Region | Asia-Pacific at 30.80% CAGR, fueled by aging population and smart hospital initiatives |

| China Market Scale | Accounts for >35% of Asia-Pacific growth, driven by AI policy support |

| Investment Activity | AI imaging startups attracted USD 3+ billion in private funding over the past 5 years |

| Regulatory Momentum | Over 700+ AI medical imaging algorithms cleared or approved globally |

| Market Outlook | AI is shifting from decision support to clinical co-pilot, becoming core diagnostic infrastructure |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2380

AI in Medical Imaging Market Regional Insights

Why North America Dominates the AI in Medical Imaging Market?

North America dominated the market in 2024. The well-established healthcare infrastructure and strong presence of technological companies increase the use of AI in medical imaging. The increasing investment in AI technology and the growing shortage of radiologists increase demand for AI in medical imaging. The strong focus on hospital workflow efficiency and increasing chronic disease prevalence requires AI in medical imaging, driving the overall growth of the market.

What is the AI in Medical Imaging Market Size in 2026?

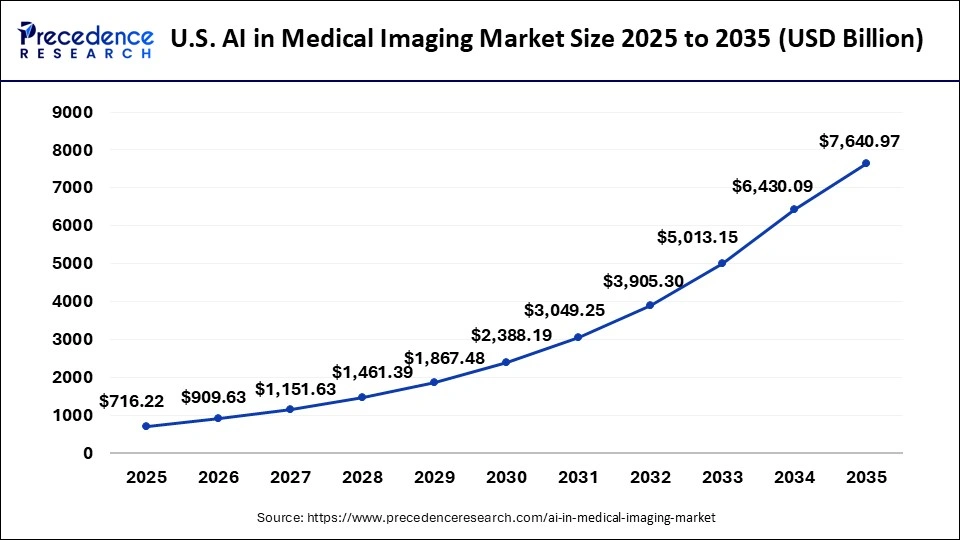

The U.S. AI in medical imaging market size is estimated to reach approximately USD 909.63 billion in 2026, growing from USD 716.22 billion in 2025, and is expected to be worth USD 7,640.97 billion by 2034, based on a projected CAGR of 26.71% for the 2026–2035 period.

This growth reflects increasing adoption of AI-driven diagnostic tools, rising imaging volumes, and strong investments in advanced healthcare technologies across the U.S. healthcare system.

U.S. AI in Medical Imaging Market Trends

The U.S. market is witnessing strong growth, driven by rising demand for faster and more accurate diagnostics, increasing imaging volumes, and the need to reduce radiologist workload. Advanced deep learning algorithms are being widely adopted to enhance image interpretation, automate workflow processes, and support early disease detection across modalities such as CT, MRI, X-ray, and ultrasound. Hospitals and diagnostic centers are leading adopters as they integrate AI tools into existing PACS and radiology workflows to improve efficiency and clinical outcomes.

How is Asia Pacific experiencing the Fastest Growth in the AI in Medical Imaging Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The aging population and growing burden of diseases like neurological disorders & cancer increase demand for AI in medical imaging for accurate diagnosis. The shortage of trained radiologists and healthcare infrastructure expansion in countries like Indonesia & China increases the adoption of AI in medical imaging. The increasing government investment in the development of smart hospitals and excessive medical imaging volume support the overall market growth.

China AI in Medical Imaging Market Trends

China’s is growing rapidly, supported by strong government backing for artificial intelligence, a large patient population, and increasing demand for early and accurate disease diagnosis. AI-based imaging solutions are widely adopted to address shortages of skilled radiologists, particularly in lower-tier cities, while improving efficiency in high-volume hospitals. Deep learning technologies dominate the market, enabling faster image analysis, improved detection of cancers, cardiovascular conditions, and neurological disorders across CT, MRI, X-ray, and ultrasound modalities.

AI in Medical Imaging Market Segmentation Insight

AI in Medical Imaging Market Revenue (USD Billion), By Clinical Area, 2023 to 2025

| Clinical Area | 2023 | 2024 | 2025 |

| Lung / Pulmonology | 267.64 | 341.59 | 438.03 |

| Brain / Neurology | 241.42 | 306.61 | 391.24 |

| Heart / Cardiology | 166.44 | 212.49 | 272.57 |

| Oncology (Other than Lung, Brain, Heart) | 149.36 | 192.5 | 249.23 |

| Musculoskeletal | 115.79 | 148.24 | 190.66 |

| Gastroenterology / Hepatology | 91.57 | 116.27 | 148.32 |

| Ophthalmology | 75.81 | 96.46 | 123.32 |

| Other Specialties (Obstetrics/Gynecology, Urology, Dermatology) | 131.97 | 161.88 | 199.25 |

The lung and pulmonary segment accounted for the largest market share in 2025, primarily due to the high global burden of respiratory diseases such as chronic obstructive pulmonary disease, pneumonia, and lung cancer. The widespread adoption of AI-driven imaging solutions for early detection, screening, and monitoring has significantly improved diagnostic accuracy and workflow efficiency in pulmonary care settings, particularly in hospitals and large diagnostic facilities.

The oncology segment is projected to grow at a notable compound annual growth rate between 2026 and 2035. This expansion is driven by the rising incidence of cancer worldwide, increasing reliance on imaging for early diagnosis and treatment planning, and growing use of AI tools for tumor detection, segmentation, and response assessment. Continued investment in precision oncology and personalized medicine further supports strong growth in this segment.

AI in Medical Imaging Market Revenue (USD Billion), By Technology Type, 2023 to 2025

| Technology Type | 2023 | 2024 | 2025 |

| Machine Learning (ML) | 205.3 | 257.01 | 323.18 |

| Deep Learning (DL) | 593.24 | 757.03 | 970.58 |

| Natural Language Processing (NLP) | 84.5 | 106.42 | 134.64 |

| Hybrid / Multimodal AI | 136.75 | 172.21 | 217.87 |

| Explainable AI (XAI) | 220.21 | 283.38 | 366.33 |

The deep learning segment held the highest market share in 2025, supported by its proven ability to analyze complex medical images with high accuracy. Deep learning algorithms excel in tasks such as pattern recognition, classification, and anomaly detection, making them highly suitable for radiology and diagnostic imaging applications. Their integration into clinical workflows has enhanced efficiency, reduced interpretation time, and improved diagnostic confidence among healthcare professionals.

The explainable AI segment is expected to register a notable CAGR from 2026 to 2035. Growing regulatory scrutiny, ethical considerations, and the need for transparency in clinical decision-making are driving demand for interpretable AI models. Explainable AI enables clinicians to understand and validate algorithm outputs, fostering trust, supporting regulatory compliance, and encouraging broader adoption of AI-based imaging solutions across healthcare organizations.

Deployment Mode Insights

The on-premise segment dominated the market in 2025, largely due to healthcare providers’ emphasis on data security, patient privacy, and regulatory compliance. On-premise systems offer greater control over sensitive medical data and allow institutions to customize AI solutions according to their operational requirements. Large hospitals and integrated health systems continue to prefer on-premise deployments for mission-critical imaging and diagnostic applications.

The edge and embedded segment is expanding at a fastest CAGR during the forecast period. Growth is supported by increasing demand for real-time image processing, low-latency decision-making, and reduced reliance on centralized infrastructure. Edge-based AI enables faster diagnostics directly at imaging devices, making it particularly valuable in emergency care, remote settings, and point-of-care applications where immediate insights are essential.

AI in Medical Imaging Market Revenue (USD Billion), By Imaging Modality, 2023 to 2025

| Imaging Modality | 2023 | 2024 | 2025 |

| X-ray | 251.13 | 318.07 | 404.75 |

| CT | 458.42 | 581.06 | 739.96 |

| MRI | 246.19 | 316.84 | 409.63 |

| Ultrasound | 145.43 | 185.11 | 236.73 |

| PET / SPECT | 56.75 | 72.92 | 94.12 |

| Other Imaging Modalities (Endoscopy, etc.) | 82.07 | 102.05 | 127.41 |

The CT segment led the market share in 2025, driven by the extensive use of computed tomography in diagnosing pulmonary, cardiovascular, neurological, and oncological conditions. AI-enhanced CT solutions support faster image interpretation, improved lesion detection, and reduced diagnostic errors. High scan volumes, combined with strong clinical reliance on CT imaging, have reinforced this modality’s leading position in the market.

The MRI segment is expected to experience rapid growth from 2026 to 2035. Advances in AI-powered image reconstruction, noise reduction, and automated analysis are improving image quality while reducing scan times. These developments are expanding the use of MRI across neurology, oncology, and musculoskeletal applications, making it an increasingly attractive modality for AI integration in advanced diagnostic workflows.

AI in Medical Imaging Market Revenue (USD Billion), By Functionality, 2023 to 2025

| Functionality | 2023 | 2024 | 2025 |

| Image Acquisition & Reconstruction | 115.12 | 147.55 | 189.99 |

| Image Enhancement & Processing | 155.19 | 197.5 | 252.55 |

| Image Analysis | 628.39 | 801.5 | 1027.11 |

| Workflow & Reporting | 174.38 | 220.6 | 280.38 |

| Predictive & Prognostic Analytics | 166.92 | 208.88 | 262.57 |

The image analysis segment dominated the market with the largest share in 2025. Strong demand for automated image interpretation, segmentation, and quantification tools has driven widespread adoption. These solutions help radiologists manage increasing imaging volumes, improve diagnostic consistency, and reduce workload. Image analysis remains a core functionality underpinning most AI applications in medical imaging.

Product Type Insights

The software segment led the market with the highest share in 2025. Software-based AI solutions are widely preferred due to their flexibility, scalability, and compatibility with existing imaging systems. Healthcare providers benefit from easier deployment, regular updates, and lower upfront costs, enabling rapid adoption of AI capabilities without the need for extensive hardware upgrades or infrastructure changes.

The AI-enabled hardware segment is expected to grow notably over the forecast period. Increasing integration of specialized processors, accelerators, and embedded artificial intelligence (AI) chip into imaging equipment supports faster data processing and real-time analytics. These hardware advancements enhance system performance, particularly in high-throughput and time-sensitive clinical environments, contributing to growing adoption across advanced diagnostic and point-of-care settings.

End-user Insights

The hospitals segment held the largest market share in 2025, supported by high patient volumes, advanced imaging infrastructure, and strong financial capacity to invest in digital health technologies. Hospitals are primary adopters of AI imaging solutions to improve diagnostic accuracy, streamline workflows, and enhance overall patient care across multiple clinical departments.

The diagnostic imaging centers segment is expected to expand at the fastest CAGR during the foreseeable period. Growth is driven by rising demand for outpatient imaging services, increasing diagnostic test volumes, and competitive pressure to improve efficiency and accuracy. AI adoption enables imaging centers to optimize throughput, reduce turnaround times, and deliver high-quality diagnostic services cost-effectively.

✚ Related Topics You May Find Useful:

➡️ Artificial Intelligence in MRI Market: Analyze how AI-powered MRI solutions are reducing scan times, improving image quality, and expanding advanced diagnostic capabilities

➡️ Artificial Intelligence in Ultrasound Imaging Market: Understand the growing role of AI in real-time ultrasound imaging, automation, and point-of-care diagnostics

➡️ Generative AI in Medicine Market: Gain insight into how generative AI is revolutionizing clinical documentation, medical imaging synthesis, and personalized treatment planning

➡️ Artificial Intelligence in Healthcare Market: Examine the broad adoption of AI across healthcare, from diagnostics and workflow automation to population health management

➡️ Diagnostic Imaging Services Market: Track the expansion of diagnostic imaging services driven by rising imaging volumes, chronic disease prevalence, and technology upgrades

➡️ Artificial Intelligence in Breast Imaging Market: Learn how AI is enhancing breast cancer screening, early detection, and diagnostic confidence in mammography and advanced imaging modalities

Top Companies in the AI in Medical Imaging Market & Their Offerings:

- Agfa-Gevaert Group: Provides the RUBEE® AI platform to automate clinical workflows and image processing within enterprise imaging systems.

- Ada Health: Offers an AI symptom assessment tool that uses clinical intelligence to assist in patient triage and diagnostic decision-making.

- Enlitic Inc: Specializes in data standardization and workflow optimization by using AI to organize and de-identify medical imaging metadata.

- CELLMATIQ GMBH: Delivers automated image analysis specifically for dentistry and ophthalmology to provide rapid, AI-assisted diagnostic reports.

- GE HealthCare: Features the Edison™ platform, hosting a vast suite of AI applications for automated image acquisition and clinical decision support.

- IBM: Provides AI-driven clinical support tools through Watson Health to assist radiologists in identifying and analyzing complex pathologies.

- NVIDIA Corporation: Offers the Clara™ framework, providing the essential computing infrastructure and SDKs for developing and deploying medical AI models.

- Microsoft: Utilizes Azure and Nuance technologies to deliver cloud-based AI solutions for diagnostic imaging and large-scale pathology research.

- Koninklijke Philips N.V.: Features the AI Manager, a platform that integrates and orchestrates third-party AI clinical applications directly into radiology workflows.

- Siemens Healthineers: Offers the AI-Rad Companion, a suite of tools that automatically performs measurements and highlights abnormalities across multiple imaging modalities.

Recent Developments in the AI in Medical Imaging Industry

- In September 2025, QuantifiCare collaborated with Legit.Health to launch first AI-enabled dermatology imaging platform for clinical trials. The collaboration accelerates the screening of patients and provides real-time treatment insights. (Source: https://www.quantificare.com/)

- In July 2025, Delhi launched India’s first AI-powered ultra-fast MRI, Excel 3T MRI, at Mahajan Imaging & Labs in Dwarka. The MRI offers real-time motion correction and contactless respiratory tracking. The MRI enhances the accuracy of diagnosis and lowers the time of scanning. The centre is equipped with full-field digital mammography, digital X-ray, echocardiography, 3D/4D AI-enabled ultrasound, and other advanced tools. (Source: https://ehealth.eletsonline.com/)

- In November 2025, Samsung India launched the R20 ultrasound system with AI tools for general imaging. The technologies included in R20 are Live BreastAssist, Deep USFF, Live LiverAssist, and auto measurement tools. The system is useful across various imaging thyroid, vascular, obstetrics, urology, abdomen, gynecology, musculoskeletal, and breast. (Source: https://www.expresshealthcare.in)

Segment Covered in the Report

By Clinical Area

- Lung/Pulmonary

- Lung cancer

- Non-cancer lung diseases

- Brain/Neurology

- Stroke/Haemorrhage

- Dementia & Neurodegenerative Diseases

- Brain Tumors/Lesions

- Heart/Cardiology

- Coronary Artery Diseases

- Heart Failure & Functional Assessment

- Congenital & Structural Heart Diseases

- Oncology

- Musculoskeletal

- Gastroenterology/Hepatology

- Ophthalmology

- Other Specialities (Obstetrics/Gynaecology, Urology, Dermatology)

By Technology Type

- Machine Learning

- Deep Learning

- CNN

- RNN/LSTM

- Transformers/ViTs

- Generative Models (GANs, Diffusers)

- Natural Language Processing (NLP)

- Hybrid/ Multimodal AI

- Explainable AI (XAI)

By Deployment Type

- On-premise

- Cloud-based

- Hybrid

- Edge/Embedded

By Imaging Modality

- X-ray

- CT Scan

- MRI

- Ultrasound

- PET/SPECT

- Other Imaging Modalities

By Functionality

- Image Acquisition & Reconstruction

- Image Enhancement &Processing

- Image Analysis

- Segmentation

- Detection

- Classification

- Quantification

- Workflow & Reporting

- Predictive & Prognostic Analytics

By Product Type

- Software

- AI Analysis Software

- AI Workflow & Reporting Tools

- AI-enabled Hardware

- Imaging Device with Embedded AI (CT, MRI, X-ray, Ultrasound)

- Edge/AI Workstations

- AI Accelerators

By End User

- Hospitals

- Diagnostic Imaging Centers

- Research & Academic Institutes

By Geography

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa (MEA)

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2380

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Explore More Market Intelligence from Precedence Research:

➡️ Embodied Intelligence & AI Humanoid Robots: Discover how embodied AI and humanoid robots are redefining human–machine interaction across healthcare, manufacturing, and service industries

➡️ Modern Manufacturing: Explore how smart factories, digital twins, and sustainable supply chains are driving next-generation industrial growth

➡️ Data Centers & Digital Infrastructure: Understand how hyperscale data centers are balancing performance, resilience, and sustainability amid rising digital demand

➡️ Generative AI in Supply Chains: See how generative AI is optimizing forecasting, logistics, and decision-making across global supply networks

➡️ Next-Generation Technologies: Track breakthrough innovations shaping future business strategies across AI, automation, and emerging technologies

➡️ Digital Transformation Strategy: Gain insight into how enterprises are building resilient digital foundations for long-term competitive advantage

➡️ Bioengineering & Healthcare Sustainability: Learn how bioengineering advances are transforming healthcare outcomes while supporting sustainability goals

➡️ Healthcare Payers Digital Transformation: Examine how AI and digital tools are reshaping payer models, claims management, and value-based care

➡️ Life Sciences Industry Insights: Explore key trends shaping the global life sciences ecosystem, from R&D to commercialization

➡️ Biopharmaceutical Industry: Analyze innovation, regulation, and investment trends driving the biopharma sector

➡️ Artificial Intelligence Market Insights: Understand the expanding role of AI across industries, including healthcare, manufacturing, and enterprise applications

➡️ AI in Healthcare: Discover how AI is improving diagnostics, patient outcomes, and operational efficiency in healthcare systems

➡️ Generative AI in Life Sciences: See how generative AI is accelerating drug discovery, clinical research, and personalized medicine

➡️ Biopharmaceutical Growth Trends: Track growth drivers, pipeline expansion, and emerging therapies in the biopharmaceutical market

➡️ Digital Therapeutics: Learn how software-based therapies are reshaping treatment approaches for chronic and mental health conditions

➡️ Life Sciences Growth Outlook: Gain insight into investment, innovation, and expansion trends across the life sciences sector

➡️ Viral Vector & Gene Therapy Manufacturing: Explore manufacturing innovations supporting scalable and efficient gene therapy production

➡️ Wellness Transformation: Understand how digital health, preventive care, and lifestyle innovation are redefining the global wellness economy

➡️ Generative AI in Healthcare: Discover how generative AI is unlocking new possibilities in medical innovation, patient care, and clinical efficiency